What is Bitcurrency?

Bitcurrency, also known as Public Currency/Fiat Currency, is a public asset issued through Bitgold-backed loans, where the public competes to issue these assets. For the sake of convenience, we refer to this Bitcurrency standard as “VRC-10”, modeled after Ethereum’s ERC-20 naming convention.

Bitcurrency is a fully decentralized digital asset issued on major open universe networks. It is a digital asset with a constant value, referred to as a constant currency. Unlike stablecoins, it is another form of legal tender rather than a competitor. Therefore, when naming and specifying it, the corresponding legal tender name is directly referenced. Currently, no such currency exists globally. Although it may seem similar, it is a completely different example, like USDT (which is a centralized product issued by Tether, a product we believe could lead to a small disaster). In the Openverse network, it serves as a competitor to USD, rather than being a product of the same kind. We hope that there will be a consensus: Bitcurrency represents the issuance of sovereign legal tender within the Openverse Square ecosystem. It is categorized as M0 (M0 refers to the total amount of cash in circulation, including cash held by banks, businesses, and households, representing the narrowest form of currency).

BTG will serve as the financial foundation for the ecosystem’s gold, while Bitcurrency will become the true standard for measuring value and exchange medium. It can serve as the base currency for trading pairs or act as a cross-ecosystem bridge between cash and electronic money (e.g., seamless transfers between Apple Pay and PayPal, where USD can be transferred between platforms without friction).

If your economic region requires the issuance of Bitcurrency in the local legal tender, please go to the community economy section to initiate and vote. Ultimately, the Openverse network will issue over 200 Bitcurrencies, covering the legal tender of sovereign nations around the world [https://www.iso.org/iso-4217-currency-codes.html]. Furthermore, when new legal tenders are introduced (e.g., the Euro in the early 21st century), additional Bitcurrencies can be freely extended.

World Currency Standards Data:

https://www.six-group.com/en/products-services/financial-information/data-standards.html

World Currency List:

https://sc.openverse.network/docs/world_currencies.xls

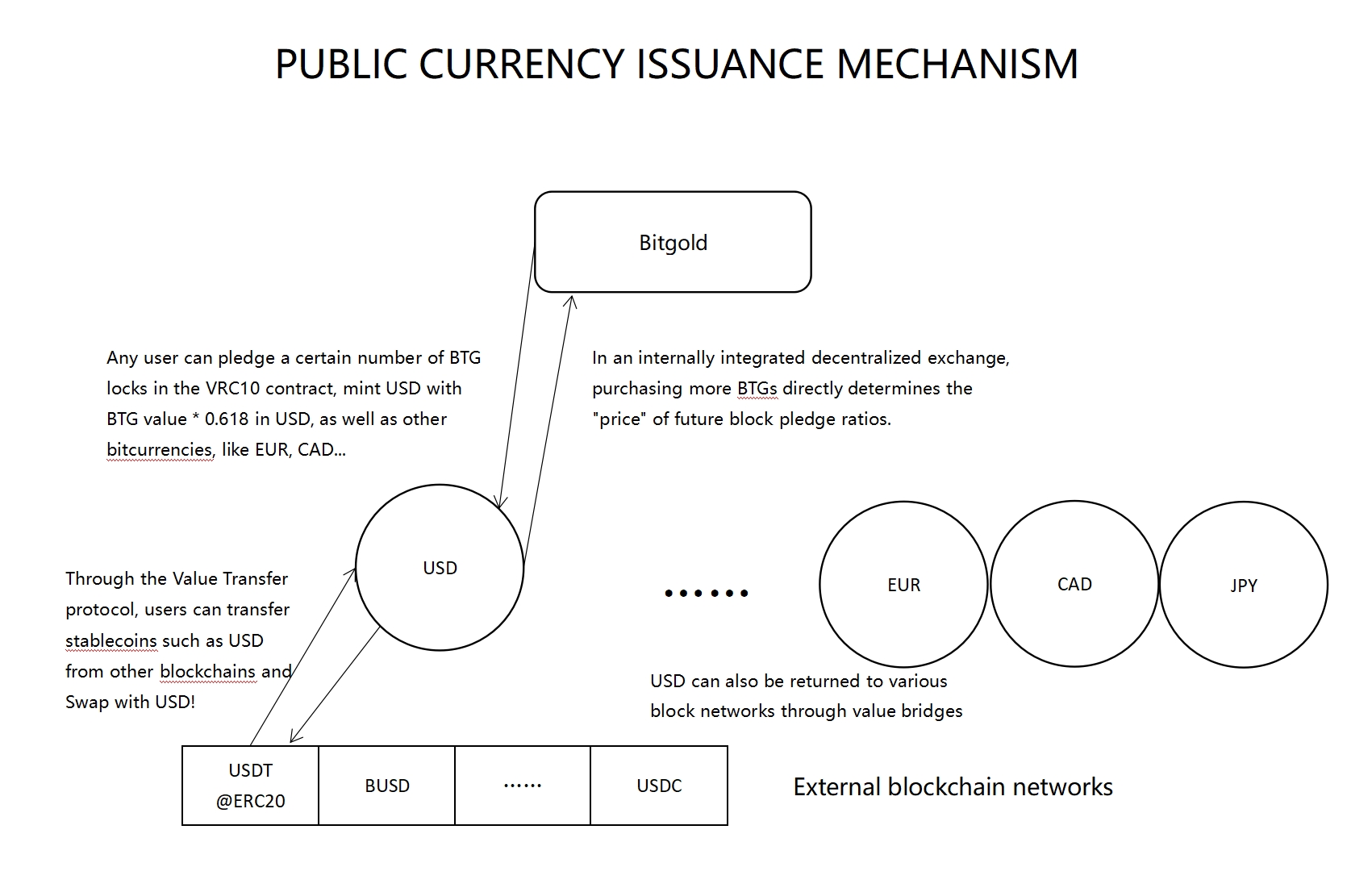

What is PCIM?

After analyzing the shortcomings of the gold standard and the central bank’s fiat currency issuance mechanism, and studying works such as Denationalization of Money, Openverse Network proposes a new approach using blockchain technology: the “Bitcoin Currency Issuance Solution – Public Currency Issuance System, PCIM.”

PCIM is a currency issuance system that generates Bitcurrency through asset-backed loans, such as Bitgold, and the participation of the entire population. It can also be referred to as the “New Gold Standard System.” There are several key points in PCIM:

Universal Participation: Any individual with standard assets can participate in competitive issuance.

Asset-Backed Loans: Assets based on collateralized loans are used to produce Bitcoin currency. When Bitcoin currency is redeemed, the underlying asset, Bitgold, should be issued in the original amount.

Preparedness for Competitive Issuance: Participants must be prepared for high-frequency, competitive issuance activities based on block cycles.

High-Frequency, Competitive Issuance Based on Block Cycles: The system operates in cycles that ensure active and competitive participation.

We can draw an analogy to real estate mortgages. A bank may issue a new currency (M0, as opposed to loans which are M1) when a property is mortgaged. When the loan is repaid, the property is released from the mortgage, and the currency used to repay the loan is destroyed.

PCIM allows participants the right to mint Bitcoin currency, which can be used in commerce and daily economic life, just like fiat currency. At the same time, participants retain the potential for appreciation of Bitgold, akin to the real estate value appreciation in the mortgage analogy.

The public issuance system may, to some extent, impact the currency issuance policies of central banks in various countries, and could even lead to “national fiat currency competition” and the “good money drives out bad money” phenomenon. We sincerely hope that society, including governments, will embrace it with a spirit of experimentation and practice.

Bitcurrency protection mechanism

- Creation Phase of the Cryptocurrency:The community should fully consider the legal and institutional framework of the respective country. In governance voting, members should cast their votes in favor or against based on these considerations.

Issuance Phase of the Cryptocurrency: In the event of a black swan event, such as a significant and abnormal increase in the issuance volume within a short period (e.g., several times the normal amount in 3 days), the community should vote in favor of implementing a blockchain hard fork.

Founder Team’s Reserved Authority: The founding team retains the authority to exercise a decisive vote in the case of extremely unreasonable circumstances and to initiate a hard fork upgrade.

Government Relations and Systemic Risk Protection: When the cryptocurrency reaches a certain scale, it is important to proactively coordinate with the local government to protect the entire financial system and prevent potential systemic risks.

End of Life via Public Opinion: Based on the aforementioned hard fork protections and the inherent advantages of PCIM (which allows for the destruction of the cryptocurrency in exchange for Bitgold), the end of life for the cryptocurrency could be determined through public opinion.

Similarity theory

F.A. Hayek, also called Friedrich A. Hayek, in full Friedrich August von Hayek, (born May 8, 1899, Vienna, Austria—died March 23, 1992, Freiburg, Germany), Austrian-born British economist noted for his criticisms of the Keynesian welfare state and of totalitarian socialism. In 1974 he shared the Nobel Prize for Economics with Swedish economist Gunnar Myrdal.

The document link for Denationalization of Money is as follows:

https://sc.openverse.network/docs/Denationalisation_of_Money.pdf.

Bitcurrency image standards

Category name: Currency. When in conflict with fiat currencies, use Bitcurrency.

For specific currencies, such as the US dollar: prioritize using the dollar symbol ($) and refer to the unit as “dollar,” which is the original unit of the dollar in the sovereign fiat currencies of various countries.

Alternative solution: When digital currency identification or value squared identification is required, use the dollar symbol ($) with the superscriptⓥ in the upper right corner. This special character can be found in the “Insert Special Character” function in document editing software such as Microsoft Word (or copied directly from this page) and formatted as a superscript. (ⓥ also serves as the public emblem of the Openverse digital asset ecosystem, similar to how ®denotes a registered trademark and ©signifies copyright).

Format: Transparent PNG

Resolution: 128×128

Right-click to save the icon.